XM Review

Overall, XM can be summarised as a highly regulated Forex Broker specializing in Forex and CFD. XM offers access to 55 currency pairs, excellent customer support and it has a trust score of 97 out of 99.

🛡️Regulated and trusted by the Financial Services Commission (FSC)

🛡️6762 new traders chose this broker in the last 90 days.

🛡️Available for global Traders.

| 🔎 Broker | 🥇 XM |

| 📌 Year Founded | 2009 |

| 👤 Amount of Staff | 450+ employees |

| 👥 Amount of Active Traders | 5,000,000+ traders worldwide |

| 📍 Publicly Traded | None |

| 📈 Regulation | Financial Services Commission (FSC) |

| ⭐ Safety and Security | High |

| 📉 Account Segregation | ✅Yes |

| 📊 Negative Balance Protection | ✅Yes |

| 💹 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | None |

| 🅱️ Managed Accounts | None |

| 💴 Minor Account Currencies | USD, EUR, GBP, JPY, AUD |

| 💶 Minimum Deposit | 5 USD |

| ⏰ Average Deposit/Withdrawal Time | 24 hours |

| 💵 Fund Withdrawal Fee | None |

| 💱 Spreads From | 0.6 pips on major pairs |

| 💷 Commissions | Zero commissions on most account types |

| 🔟 Number of Base Currencies | 11+ |

| 💰 Swap Fees | ✅Yes |

| 📊 Leverage | Up to 1:888 |

| 💹 Margin Requirements | Variable |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 📈 Order Execution Time | 0.01 seconds |

| 🖥️ VPS Hosting | Free VPS |

| 📍 CFDs Total | 1,000+ |

| 📑 CFD Stock Indices | 14+ |

| 🍎 CFD Commodities | 8+ |

| 📌 CFD Shares | 1,200+ |

| 🅰️ Deposit Options | Bank Wire, Credit/Debit Card, eWallets, Local Payment Methods |

| 🅱️ Withdrawal Options | Bank Wire, Credit/Debit Card, eWallets, Local Payment Methods |

| ⭐ Trading Platforms | MetaTrader 4, MetaTrader 5 |

| 💻 OS Compatibility | Windows, macOS, Android, iOS |

| 🖥️ Forex Trading Tools | Technical analysis, trading signals, economic calendar, Autochartist |

| 🩷 Customer Support | Multiple Channels |

| 🥰 Live Chat Availability | 24/5 |

| 💌 Customer Support Email | [email protected] |

| ☎️ Customer Support Contact Number | +501 223-6696 +501 227-9421 |

| 💡 Social Media Platforms | Facebook, Twitter, Instagram, LinkedIn, YouTube |

| ✏️ Languages Supported | 25+ |

| 📔 Forex Course | ✅Yes |

| 📚 Webinars | ✅Yes |

| 📒 Educational Resources | Video tutorials, trading guides, market analysis, blog |

| 🤝 Affiliate Program | ✅Yes |

| 🗃️ Amount of Partners | 100,000+ |

| 🗄️ IB Program | ✅Yes |

| 🏆 Sponsors events or teams | ✅Yes |

| 🏷️ Rebate Program | ✅Yes |

| 🔖 Cent or Micro Accounts | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Overview

XM Group is a globally recognized leader in the trading industry, providing exceptional trading conditions to millions of clients worldwide. With over 15 million clients across more than 190 countries, XM has established itself as a reliable platform committed to delivering fair, fast, and customer-focused services. The company has executed over 8.5 billion trades, all with zero requotes or rejections.

Known for its award-winning customer service, XM ensures all clients, regardless of account size, enjoy a premium trading experience. The platform upholds a strict no requotes, no rejections policy, and guarantees that 99% of trades are executed in under a second, making it a top choice for traders seeking efficiency and reliability.

Frequently Asked Questions

What makes XM Group different from other trading platforms?

XM Group stands out by offering the same excellent trading conditions to all clients, regardless of account size. With a focus on fairness, they guarantee no requotes or rejections, ensuring smooth, real-time execution of trades.

How fast are trades executed on XM Group?

XM Group ensures that 99% of trades are executed in less than one second, allowing for seamless execution without slippage, so your strategies stay aligned with market prices.

Is customer support available in multiple languages?

Yes, XM Group provides support in over 30 languages, ensuring an award-winning customer experience that caters to clients from around the world.

How many clients trust XM Group globally?

XM Group serves over 15 million clients across more than 190 countries, offering access to the same high-quality trading experience to every individual.

Our Insights

XM Group has firmly established itself as a leader in the trading industry, prioritizing fair trading practices, fast execution times, and a human-centered approach. With over 15 million clients worldwide and a reputation for reliability, XM provides a top-tier trading experience to everyone, regardless of account size.

Whether you’re a beginner or an experienced trader, XM’s no requotes, no rejections policy and award-winning customer support make it an excellent choice for those seeking a trusted trading partner.

Detailed Summary

| 🔎 Broker | 🥇 XM |

| 📌 Year Founded | 2009 |

| 👤 Amount of Staff | 450+ employees |

| 👥 Amount of Active Traders | 5,000,000+ traders worldwide |

| 📍 Publicly Traded | None |

| 📈 Regulation | Financial Services Commission (FSC) |

| ⭐ Safety and Security | High |

| 📉 Account Segregation | ✅Yes |

| 📊 Negative Balance Protection | ✅Yes |

| 💹 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | None |

| 🅱️ Managed Accounts | None |

| 💴 Minor Account Currencies | USD, EUR, GBP, JPY, AUD |

| 💶 Minimum Deposit | 5 USD |

| ⏰ Average Deposit/Withdrawal Time | 24 hours |

| 💵 Fund Withdrawal Fee | None |

| 💱 Spreads From | 0.6 pips on major pairs |

| 💷 Commissions | Zero commissions on most account types |

| 🔟 Number of Base Currencies | 11+ |

| 💰 Swap Fees | ✅Yes |

| 📊 Leverage | Up to 1:888 |

| 💹 Margin Requirements | Variable |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 📈 Order Execution Time | 0.01 seconds |

| 🖥️ VPS Hosting | Free VPS |

| 📍 CFDs Total | 1,000+ |

| 📑 CFD Stock Indices | 14+ |

| 🍎 CFD Commodities | 8+ |

| 📌 CFD Shares | 1,200+ |

| 🅰️ Deposit Options | Bank Wire, Credit/Debit Card, eWallets, Local Payment Methods |

| 🅱️ Withdrawal Options | Bank Wire, Credit/Debit Card, eWallets, Local Payment Methods |

| ⭐ Trading Platforms | MetaTrader 4, MetaTrader 5 |

| 💻 OS Compatibility | Windows, macOS, Android, iOS |

| 🖥️ Forex Trading Tools | Technical analysis, trading signals, economic calendar, Autochartist |

| 🩷 Customer Support | Multiple Channels |

| 🥰 Live Chat Availability | 24/5 |

| 💌 Customer Support Email | [email protected] |

| ☎️ Customer Support Contact Number | +501 223-6696 +501 227-9421 |

| 💡 Social Media Platforms | Facebook, Twitter, Instagram, LinkedIn, YouTube |

| ✏️ Languages Supported | 25+ |

| 📔 Forex Course | ✅Yes |

| 📚 Webinars | ✅Yes |

| 📒 Educational Resources | Video tutorials, trading guides, market analysis, blog |

| 🤝 Affiliate Program | ✅Yes |

| 🗃️ Amount of Partners | 100,000+ |

| 🗄️ IB Program | ✅Yes |

| 🏆 Sponsors events or teams | ✅Yes |

| 🏷️ Rebate Program | ✅Yes |

| 🔖 Cent or Micro Accounts | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Frequently Asked Questions

What makes XM Group different from other trading platforms?

XM Group stands out by offering the same excellent trading conditions to all clients, regardless of account size. With a focus on fairness, they guarantee no requotes or rejections, ensuring smooth, real-time execution of trades.

How fast are trades executed on XM Group?

XM Group ensures that 99% of trades are executed in less than one second, allowing for seamless execution without slippage, so your strategies stay aligned with market prices.

Is customer support available in multiple languages?

Yes, XM Group provides support in over 30 languages, ensuring an award-winning customer experience that caters to clients from around the world.

How many clients trust XM Group globally?

XM Group serves over 15 million clients across more than 190 countries, offering access to the same high-quality trading experience to every individual.

Our Insights

XM Group has firmly established itself as a leader in the trading industry, prioritizing fair trading practices, fast execution times, and a human-centered approach. With over 15 million clients worldwide and a reputation for reliability, XM provides a top-tier trading experience to everyone, regardless of account size.

Safety and Security

At XM Group, your safety and security are our top priority. XM is fully authorized and regulated by reputable authorities, ensuring that clients can trade with confidence. XM Global Limited is registered with the Financial Services Commission (FSC) under the Securities Industry Act 2021, holding license number 000261/4.

This regulatory oversight guarantees strict adherence to industry standards, protecting your funds and personal data. XM’s commitment to security offers clients peace of mind, knowing that their trading experience is safeguarded by both global financial regulations and advanced security measures.

Frequently Asked Questions

Is XM Group regulated?

Yes, XM Group is authorized and regulated by the Financial Services Commission (FSC) under the Securities Industry Act 2021, ensuring that all client funds and personal information are protected by strict regulatory standards.

What is the Financial Services Commission (FSC)?

The FSC is a regulatory body that oversees financial institutions to ensure they operate in compliance with industry standards. XM Global Limited is licensed by the FSC to provide secure and reliable trading services.

How does XM ensure the safety of my data?

XM Group uses advanced encryption technologies and security protocols to protect your personal and financial data. They comply with strict data protection regulations to safeguard your privacy.

Can I trust XM Group with my funds?

Yes, XM Group adheres to strict financial regulations, and client funds are kept in segregated accounts to ensure their safety. The regulatory oversight by reputable authorities like the FSC adds an extra layer of protection for your investments.

Our Insights

XM Group’s commitment to safety and security is reflected in its regulatory status and adherence to global standards. As a licensed entity under the Financial Services Commission, XM provides a trustworthy and secure trading environment.

The company ensures that client funds are protected with segregation and uses advanced encryption to safeguard personal information. With strong regulatory backing and robust security measures, XM Group is a safe choice for traders looking to invest with confidence.

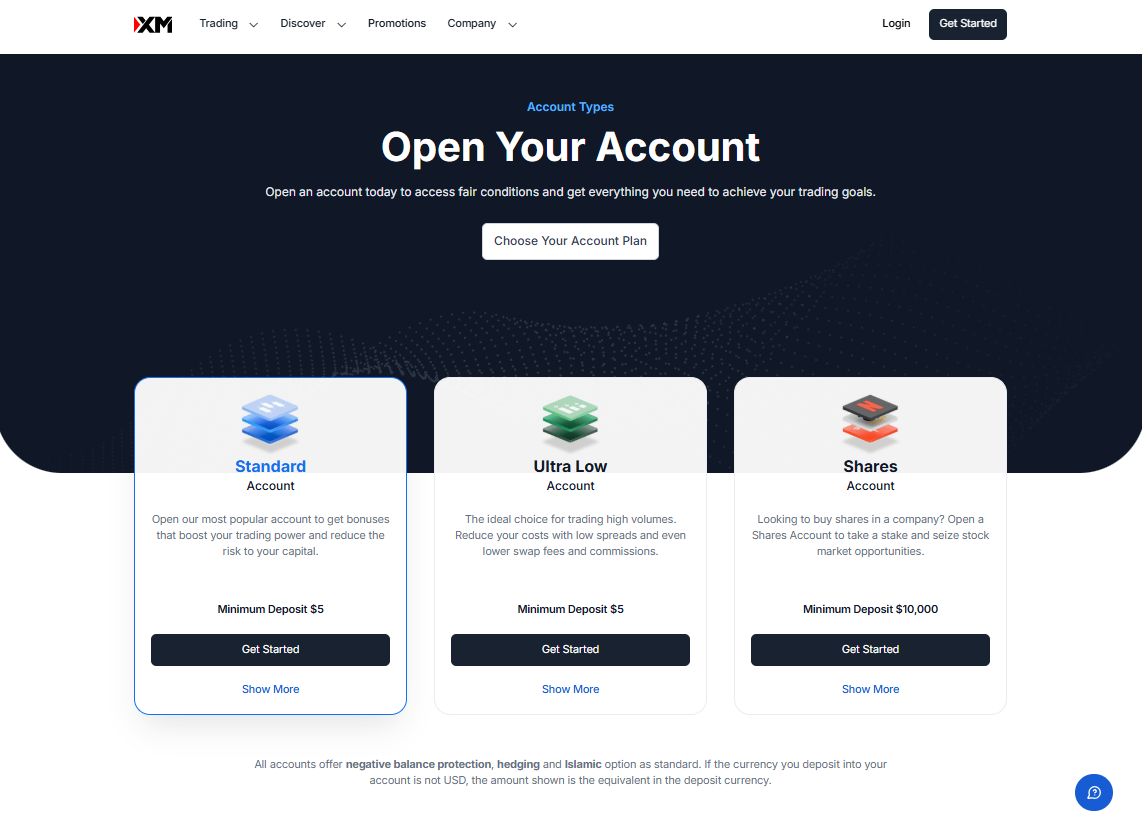

Minimum Deposit and Account Types

XM Group offers a variety of account types to cater to different trading preferences. The Standard Account, with a minimum deposit of just $5, is popular for its bonuses, low spreads (starting at 1.6 pips for EURUSD), and access to a wide range of markets, including Forex, stocks, and cryptocurrencies. It offers leverage of up to 1,000:1 and a 20% stop-out level, with swap-free and commission-free trading.

The Ultra Low Account, also with a $5 minimum deposit, offers tighter spreads (as low as 0.8 pips for EURUSD) and is designed for high-volume traders. The Shares Account, requiring a $10,000 deposit, is perfect for those looking to trade individual stocks, offering a 1:1 leverage ratio and swap-free, commission-free trading.

All accounts come with negative balance protection, hedging options, and an Islamic account choice. A demo account is also available for risk-free practice.

Frequently Asked Questions

What is the minimum deposit required to open an account with XM Group?

The minimum deposit varies depending on the account type. For the Standard and Ultra Low Accounts, it’s $5, while the Shares Account requires a $10,000 deposit.

What are the spreads like on the different account types?

The spreads vary based on the account type. The Standard Account offers spreads starting from 1.6 for EURUSD, while the Ultra Low Account offers even tighter spreads, starting from 0.8 for EURUSD.

Is there any commission charged on trades?

No, XM Group offers commission-free trading on all account types, including the Standard and Ultra Low Accounts.

What features are available across all account types?

All account types come with negative balance protection, hedging, and an Islamic option, providing traders with enhanced security and flexibility.

Our Insights

XM Group offers a well-rounded selection of account types to meet the diverse needs of traders. Whether you’re just starting with the Standard Account or looking to trade high volumes with the Ultra Low Account, XM ensures that all traders have access to competitive spreads and flexible conditions.

For those interested in stocks, the Shares Account provides an excellent platform to directly invest in companies. With no commission charges, low minimum deposits, and features like negative balance protection, XM Group delivers an accessible and secure trading experience for all levels of traders.

How to Open an Account with XM

Opening an account with XM is simple. Follow these steps to get started:

- Go to the XM website and click “Open a Real Account.”

- Select the account type that suits your trading preferences.

- Fill out the online account application form.

- Choose between MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

- Specify your desired account leverage.

- Complete the identity verification process.

- Deposit funds via bank wire, credit card, or e-wallet.

Once your account is verified and funded, you can start trading on your chosen platform.

Trading Platforms and Software

XM offers two robust trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with a mobile app for trading on the go.

MetaTrader 4 (MT4)

MT4 is a popular, user-friendly platform known for its customization options and advanced technical analysis tools. Supporting multiple languages, it provides a variety of indicators and drawing tools, making it suitable for traders of all experience levels.

MetaTrader 5 (MT5)

MT5 is an upgraded version of MT4, featuring additional capabilities like support for both hedging and netting. It also includes an economic calendar, which keeps traders informed of market events to help them make more informed trading decisions.

Mobile App

The XM mobile app is available for both Android and iOS, offering secure login options such as fingerprint and face recognition. It provides real-time alerts, charting tools, and full trading functionality, allowing users to trade and monitor markets from anywhere.

Frequently Asked Questions

What is the difference between MetaTrader 4 (MT4) and MetaTrader 5 (MT5)?

MT4 is a popular, user-friendly platform with customization options and advanced technical analysis tools. MT5 is an upgraded version, offering additional features like support for both hedging and netting, as well as an economic calendar to help traders make more informed decisions.

Can I trade on the go with XM?

Yes, XM offers a mobile app available on both Android and iOS, allowing you to trade and monitor markets from anywhere. The app includes real-time alerts, charting tools, and secure login options like fingerprint and face recognition.

Is MT4 suitable for all levels of traders?

Yes, MT4 is designed to be accessible for traders of all experience levels. It offers a variety of indicators, drawing tools, and customization options, making it a versatile platform for both beginners and advanced traders.

Does MT5 offer any additional features compared to MT4?

Yes, MT5 includes extra features such as support for hedging and netting, as well as an economic calendar to keep traders updated on market events, providing additional tools to enhance trading decisions.

Our Insights

XM offers robust and versatile trading platforms with MT4 and MT5, catering to traders of all levels. MT4 is ideal for those looking for a user-friendly platform with advanced analysis tools, while MT5 takes things further with enhanced features like hedging, netting, and an economic calendar.

Fees, Spreads, and Commissions

XM offers competitive fees, spreads, and commission structures across its account types, providing flexible trading conditions for all traders. The Standard Account, with a minimum deposit of $5, features spreads starting at 1.6 pips for EURUSD, while the Ultra Low Account offers even tighter spreads, beginning at 0.8 pips for EURUSD, making it ideal for high-volume traders seeking to minimize costs.

Both accounts are commission-free and offer swap-free options. The Shares Account, requiring a $10,000 deposit, focuses on stock trading and also provides commission-free and swap-free conditions.

All accounts include benefits such as negative balance protection, hedging options, and an Islamic account choice.

Frequently Asked Questions

What is the minimum deposit for opening an account with XM Group?

The minimum deposit for both the Standard and Ultra Low Accounts is $5, while the Shares Account requires a $10,000 deposit.

What are the spreads like on XM Group accounts?

The Standard Account offers spreads starting from 1.6 for EURUSD, while the Ultra Low Account features even tighter spreads, starting from 0.8 for EURUSD.

Are there any commissions charged on trades?

No, all XM Group accounts, including the Standard, Ultra Low, and Shares accounts, are commission-free.

Can I trade shares with XM Group?

Yes, XM Group offers the Shares Account, which allows you to buy and sell shares directly, with a minimum deposit of $10,000.

Our Insights

XM Group offers transparent and competitive fees, making it an attractive choice for traders across different levels and markets. With low spreads, commission-free trading, and swap-free options, the Standard and Ultra Low Accounts provide cost-effective conditions, especially for high-volume traders.

For those interested in stock trading, the Shares Account offers an excellent platform with no commissions or swaps. XM’s commitment to providing flexible trading conditions, along with features like negative balance protection, ensures a secure and efficient trading experience.

Markets Available for Trade

They provide a choice of 55 currency pairs, including major, minor, and exotic currencies. Furthermore:

- 31 cryptocurrencies

- 1,337 stock CFDs

- 8 commodities

- 20 equity indices

- 5 precious metals

- 8 distinct energy commodities

Additionally, the platform provides direct access to 100 individual shares, enabling traders to participate in specific companies.

Frequently Asked Questions

How many currency pairs can I trade with XM?

XM offers a selection of 55 currency pairs, including major, minor, and exotic pairs.

Can I trade cryptocurrencies with XM?

Yes, XM provides access to 31 cryptocurrencies, allowing you to trade popular digital assets.

Does XM offer stock CFDs?

Yes, XM offers 1,337 stock CFDs, covering companies from a variety of industries worldwide.

What commodities and indices can I trade on XM?

XM provides trading opportunities in 8 commodities, 20 equity indices, and 5 precious metals, as well as 8 energy commodities.

Our Insights

XM offers an extensive range of trading instruments, including forex, cryptocurrencies, stocks, commodities, and indices. With access to 55 currency pairs, 31 cryptocurrencies, and a broad selection of CFDs and individual shares, XM caters to diverse trading strategies and asset preferences, making it a versatile choice for traders.

Educational Resources

XM Group’s Learning Centre offers a wide range of resources for traders at all levels. With free webinars, daily market analysis, and live sessions such as “Forex Power Hour” and “US Market Open Hour,” traders can learn at their own pace. Expert instructors provide valuable insights into strategies, technical indicators, and macroeconomic events, helping traders make informed decisions and enhance their skills.

Whether you’re new to trading or looking to refine your strategy, XM’s educational content is designed to support your growth.

Frequently Asked Questions

What educational resources are available at XM Group?

XM Group offers a wide range of resources, including free webinars, live trading sessions like “Forex Power Hour” and “US Market Open Hour,” daily market analysis, and in-depth guides on various trading strategies.

Can I access XM’s educational content in my language?

Yes, XM provides webinars in multiple languages, allowing you to learn in the language you are most comfortable with.

Do I need to be an experienced trader to benefit from XM’s Learning Centre?

No, XM’s Learning Centre is designed for traders of all levels, from beginners to experts. The content covers basic strategies as well as advanced techniques.

Are the live education sessions free?

Yes, all of XM’s live education sessions, including webinars and market analysis, are free to access.

Our Insights

XM Group offers a robust Learning Centre that caters to traders at every level, providing a wealth of resources to improve trading skills. With free live education, expert insights, and content available in multiple languages, it’s an excellent platform for anyone looking to enhance their trading knowledge and make more informed decisions.

Whether you’re a novice or an experienced trader, XM’s comprehensive educational tools will support your growth.

Pros and Cons

| ✅ Pros | ❌ Cons |

| XM has an extremely low 5 USD minimum deposit | XM charges currency conversion fees |

| There are several bonuses offered | There are strict bonus terms and conditions |

| Traders can access fee-free deposit methods | There are limited payment methods for deposits |

Conclusion

XM is a top-tier forex and CFD broker that combines a high level of security, a wide variety of account types, and advanced trading tools. Whether you’re a novice looking for educational resources or an experienced trader seeking robust trading platforms and leverage, XM provides a comprehensive solution for all types of traders.

You might also like:

Faq

XM Group offers various account types, including the Standard Account, Ultra Low Account, and Shares Account. These accounts cater to different trading needs, from low spreads for high-volume traders to stock trading with a higher minimum deposit.

Yes, XM Group is authorized and regulated by reputable financial authorities, ensuring a secure and trustworthy trading environment for its clients.

XM Group provides two powerful platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms offer advanced trading tools, and XM also provides a mobile app for trading on the go.

Yes, XM offers a mobile app available on both Android and iOS. The app provides secure login, real-time alerts, charting tools, and full trading functionality, allowing you to trade from anywhere.

XM Group offers a comprehensive Learning Centre, including free webinars, live trading sessions, market analysis, and expert-led education. Resources are available in multiple languages and cater to traders of all experience levels.

XM is a very safe broker and I do not think any trader out there doubts it. The broker is very popular amongst traders for good reason.

Yeah… thats very true. I do not think I have met a trader yet who does not know the broker. However, I think it might have to do with region… it might be more popular in some regions than others. I have not traveled everywhere, but I am just making an intelligent guess since that is how most things are.

Nice and comprehensive review. I am glad that the broker I recently chose to trade has an excellent rating. I mean I explored a lot before I made the decision, and what sealed the deal for me was their promotions. You start immediately with a $30 no-deposit bonus, and then a two-tier bonus of 50% and 20% is waiting for you when you deposit your trading account.

XM offers a lot of types of trading accounts with various beneficial conditions and I am sure everyone will find a suitable account that aligns with their trading strategies.

I chose the ultra low standard account and there are low spreads starting from 0,6 pips, high leverage up to 1:1000 and hedging mode allowed. By the way, the minimum deposit threshold is 5$.

XM’s platform offers a lot of advanced features and tools. This is great for experienced traders looking for a powerful platform, but would love 24/7 support instead of 24/5 as I Trade over the weekends.

XM’s got everything I want to trade, from forex to stocks, but sometimes their support takes a while to get back to me.

I love the variety XM offers – it keeps my portfolio interesting. Just wish their customer service was a bit faster.

Can’t complain about XM’s selection of instruments – it’s huge. But sometimes I get stuck waiting for support to answer my questions.

XM’s the place to be if you like to trade a bit of everything. Just be prepared to wait a bit if you need help.

I’ve diversified my portfolio nicely thanks to XM’s wide range of instruments. However, their customer service could be more responsive.

Good day Chloe,

Thank you for your review. XM takes customer service very seriously I am sure the will improve and investigate this matter. We are glad to hear that they are providing a wide range of instruments to assist with your trading style.

XM’s platform is intuitive and well-designed. But those withdrawal fees for certain methods definitely add up.

I can’t fault XM’s platform – it’s smooth and user-friendly. Just keep those withdrawal fees in mind when choosing your method.

XM’s platform is perfect for beginners. Just be aware of the withdrawal fees before you start trading.

XM’s educational materials have helped me learn so much. But I’ve noticed the spreads can get pretty wide when the market gets crazy.

I appreciate all the learning tools XM provides. Just watch out for those spreads – they can fluctuate depending on market conditions.

I am kinda new in this sphere and I had some questions about accounts and platforms, and before I even wrote to support, I found almost all my answers in FAQs. Moreover, support answered relatively fast and I got all the info I needed

Oh WOW what a pleasure to hear , XM is a very transparent broker and well established !! Thank you and welcome to the trading world 🙂

XM is great for newbie traders because of their educational resources. However, the spreads aren’t always the most competitive.

XM is an very user-friendly platform, and gives great customer service . your input is very helpful!! Thank you

I’ve learned a lot from XM’s educational materials. But the spreads can definitely be better, especially during volatile times.

Its great to hear the tools that XM’s are providing are assisting you in your learning structure.

XM’s educational platform is top-notch. It’s just a shame the spreads can get so wide sometimes.

Thank you so much for your review. Your input is valuable to us as well as XM!!

As a VIP member, XM’s customer support is top-notch. But I wish they had more robust social trading features.

Thank you for taking the time to Review us. Great to have a VIP add some input.

XM really takes care of its VIP clients. But if you’re into social trading, they’re not the best option.

That’s a great point! XM is definitely known for spoiling their VIP clients with exclusive events and workshops. We thank you for your review. XM will value your input.

Maybe I am not an expert yet, but one doesn’t need to be an expert to see that trading on this platform is cost effective.

Okay, the spreads can be arguable, although I think of them as tight ones, but what no one can argue is their commission structure. Some of the common fees with other brokers are absent here, like the swap fees.

Thank you for taking the time to review XM, You’re absolutely right! It’s fantastic that you’re finding this platform cost-effective, even as a new trader. Tradable markets are all about finding an edge, and minimizing fees is a smart way to do that.

The VIP treatment at XM is great. But if they expanded their social trading options, that would be awesome.

I hear you completely! XM definitely seems to understand how to pamper their VIP clients. Those exclusive events and workshops sound fantastic!

I love the personalized support I get as an XM VIP. However, their social trading platform is pretty basic.

Have you spoken to your dedicated representative can offer any insights or alternative solutions for social trading within XM’s platform. They might be aware of upcoming features or suggest workarounds.

XM’s VIP customer support is amazing. But if you’re looking for a more social trading experience, you might want to look elsewhere.

XM sounds like a great choice for someone who values excellent customer support, but maybe not the best for social aspects of trading.

I decided to share my history with XM. I switched here briefly from another company just to test myself in the competition. After doing well and seeing the conditions, I stayed here. So much time has passed, and I didn’t regret my choice.

Thank you for taking the time to share your experience. We are so happy to hear XM is providing to all your needs.

XM offers a comprehensive range of trading instruments and an easy-to-use platform. Their educational resources have significantly improved my trading skills.

We are grateful for your review! It truly makes a difference, Thank you

Trading with XM has been a smooth experience. Their platform is intuitive, and their market analysis is always detailed and reliable.

We’re so glad you had a positive experience! Thanks for sharing your review.

I highly recommend XM for their wide selection of trading instruments and user-friendly interface. Their customer support is knowledgeable and responsive.

Thank you so much for this review. Totally agree customer support is very important to have in the trading industry.

XM’s trading platform is top-notch, offering a wide variety of instruments. Their educational materials are extremely helpful for traders of all levels.

Thank you for the review , it give beginner traders confident hearing such great input.

Very satisfied with XM’s trading services. Their platform is efficient, and their educational resources are invaluable for improving trading strategies.

We are so glad that you are happy with XM’s platform and their offerings.

XM provides exceptional trading tools and a vast range of instruments. Their platform is easy to navigate, and their customer support is always ready to assist.

Thank you so much for sharing your experience with us.

XM’s platform is well-designed and user-friendly. Their educational resources have helped me become a more confident trader.

This is great news. We are thrilled you have found a platform that works well and has helped you so much.

I appreciate the variety of instruments available on XM’s platform. Their customer support team is always prompt and helpful.

Thank you for your review on XM’s platform. We are pleased to hear your input.

This is a really solid broker with multiple international regulations. These guys have if not best, maybe one of the best reputations in the market, trusted by many brokers. They have earned their reputation by being consistent.

Thank you so much for taking the time to do a review. We truly appreciate your input.

XM’s trading platform is reliable and easy to use. Their educational materials are excellent for both beginners and experienced traders.

Thank you for the XM review , we truly apricate your feedback.

I’ve had a great experience with XM. Their platform is intuitive, and their range of trading instruments is impressive. Their customer support is very professional.

Thank you for sharing your experience.

XM offers a user-friendly trading platform with intuitive features. Their customer support is excellent and always available to assist.

Thank you so much for taking the time to review.

I’m highly impressed with XM’s fast execution and competitive spreads. Their detailed market analysis helps me make informed decisions.

We apricate your review, thank you

XM provides a robust trading environment with a wide range of instruments. Their educational resources are valuable for traders of all levels.

Thank you for the review.

The trading experience with XM has been exceptional. Their platform is reliable, and their customer service is consistently responsive.

This is great to hear. Thank you for taking the time to review.

XM’s low spreads and efficient trade execution make it a great choice for active traders. Their market insights are always on point.

Great to hear you find their market insights are assisting you with your decision making. Thank you

I appreciate XM’s transparent fee structure and fair trading conditions. Their platform is stable and easy to navigate.

Thank you for your review.

XM is my first broker in my trading career and honestly, I didn’t know a lot about them but their trading conditions definitely attracted me.

I know that spreads play a huge role in successful trading and that’s why I chose this company. I’m trading via a standard trading account and I like that spreads start from 1 pips averagely and it seems these spreads are pretty tight.

Thank you so much for taking the time to review.

As far as I have been using the platform, I have only reached out to the support team very few times, maybe once or twice. One at registration and once more. They are very effective.

Thank you for your review on XM. Great you are happy with the platform.

I like my broker’s trading conditions

I have leverage up to 1:1000 for some assets.

And 0 commission

Spreads are narrow. I can’t say for sure, but several times they were less than 1 pips on EUR/USD

Thank you for your details review, we are so pleased to hear that you are happy with XM’s offerings.

Trading with XM has been a fantastic experience due to their impressive selection of instruments. The user-friendly platform makes it easy for me to explore different assets and adjust my strategies as needed.

Thank you so much for the great review.

I’m really impressed with XM’s educational resources, which have greatly enhanced my trading knowledge. The comprehensive tutorials and webinars have helped me build confidence in my trading decisions.

Thank you so much for your review.

XM offers an exceptional trading platform that combines efficiency with a wide range of tools. Their detailed market analysis has proven invaluable, allowing me to make well-informed choices in my trades.

Thank you so much for taking the time to do a review.

I appreciate the seamless execution speed at XM, which allows me to capitalize on market opportunities without delays. It’s reassuring to know that I can trust their platform for timely trades.

Thank you so much for taking the time to review XM, we are pleased to hear that there are on point without delays.

XM’s commitment to providing a robust trading experience is evident in their diverse range of instruments and excellent educational materials. I feel well-equipped to navigate the markets and enhance my trading skills.

Thank you so much for sharing your experience with us.